Picking a credit card can be hard work when your mailbox is flooded with pre-approved offers.

How do you compare credit cards to find the best deal? With only so much room in your wallet, you have to decide on a limited number of offers. Luckily, your search for the appropriate card doesn’t have to be so hard. With most types of credit cards falling into common categories, you can easily identify what card offers are most relevant to your financial situation.

Types of Credit Cards – Organized By Main Features and Use

The first step in choosing a card is easy – compare the benefits to see what classification of credit card you are interested in. Your lifestyle will help narrow down your decision when finding the best credit card:

Low Fee Balance Transfer Cards: These cards can be most helpful when trying to manage your debt – transferring your balance to a lower interest card will save you money in the long run. These cards are used as tools to become a more responsible borrower and to erase debt or build a credit score.

New/No/Low Credit Cards & Student Cards: Young or inexperienced borrowers such as students have less credit card opportunities available to them. These cards are used as stepping stones to better cards. Secured lines of credit are a related option for new borrowers, backed by a security deposit. Secured cards are sometimes the only option for riskier borrowers or those with no credit history.

Rewards Cards: Among more experienced cardholders, rewards cards allow cardholders to redeem points from purchases towards gift cards, merchandise and statement credits. Rewards cards are an attractive way to get more out of your purchases, as long as the rewards you claim are useful to you if your redemption options are limited.

Cash Back Credit Cards: These cards are a subcategory of rewards cards, and are often less restrictive than regular rewards cards. Cash back cards normally offer statement credits or other cash-equivalent rewards. Look for rewards to be stated as a percentage of your monthly purchases. Many cards only accrue cash back balances for payments rather than charges themselves. Citi® Double Cash Card rewards both for each swipe and again for each payment.

Low APR Interest & No/Low Fee Cards: more cautious borrowers who are more careful with their credit cards may opt for a low interest card. These cards offer peace of mind for those who have unexpected expenses and may have to carry a balance. Low fee cards appeal to those who may miss a payment, have a check bounce or face other issues. People who carry a balance regularly should aim for a low APR card due to the cost savings it can offer them.

Travel/Concierge Cards: These cards are popular among business people, travel junkies, and retirees alike. Expect features like car rental insurance, purchase protection, airline miles and hotel/restaurant discounts. Travel cards often restrict reward redemptions to air fare, hotel stays, and similar expenses, but what they give up in flexibility they gain in better reward value. Travel cards can be a good choice if you spend money on travel regularly, as your higher reward values are in categories that are relevant to your purchasing patterns. Concierge cards often offer better and expanded services, usually at the cost of an annual card fee. Many card issuers offer to waive these fees for the first year.

As you can see, most credit cards try to appeal to different borrowers. The most value you will get out of any credit card will come from one that fits your needs. Remember, some cards fall into multiple categories, so you don’t have to always compromise when selecting a card. Many card issuers offer benefits like the rental insurance and purchase protection as an added benefit even if their card has another focus. Another feature which is becoming more popular across multiple cards is Free FICO Credit Score Reporting with each balance statement. This is especially useful for people trying to track their progress with improving their credit score.

Directly Comparing Credit Card Offers –

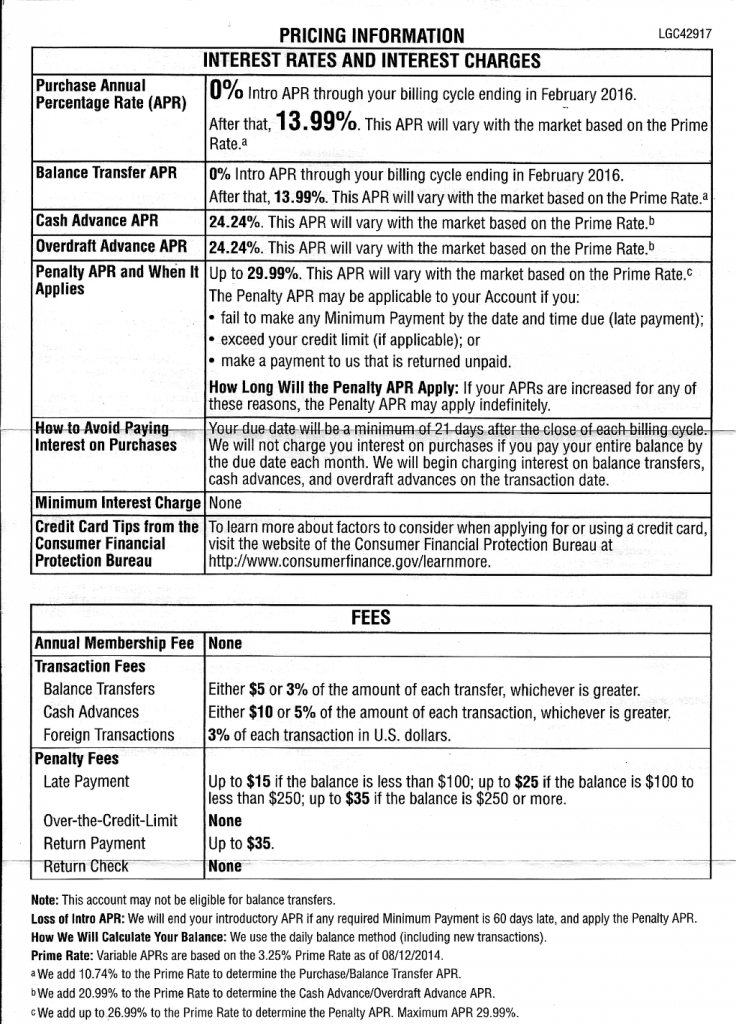

Everyday purchase decisions can be difficult to make because companies make it hard to compare price information. Fortunately, finance is heavily regulated; credit card offers can be easily compared for interest rates, fees and payment schedules. Regulation Z, guided by the Truth-in-lending act, requires that credit card issuers disclose their fees in a consistent table format.

You’ll see a sheet with this pricing information included with every credit card offer you receive. With each section labeled the same way, you can easily compare offers you have in hand for differences in penalties, standard fees, and rate ranges. This is an indispensable tool when trying to compare similar cards in the same category. If you are worried about missing payments or your APR going up, you can directly compare offers to avoid shortcomings of individual cards. On the other hand, if a card’s other benefits (like cash back amounts) outweigh unimportant features (like penalty APR for someone who never misses payments), you can make an educated decision and feel confident in your choice. The best way to choose a credit card is to get the benefits that matter to you while being assured the card is not risky for your spending habits. Do the math, compare the numbers. No two cards are created equal, nor is any card meant for everyone.

You actually make it appear really easy together with

your presentation but I find this topic to be actually something that I feel I might by no means understand.

It sort of feels too complex and very wide for me.

I am looking forward for your next post, I will try to get the cling of it!

Escape room

Everything is very open with a really clear explanation of the issues.

It was definitely informative. Your website is very helpful.

Many thanks for sharing!

I noticed that your dealsthatappeal.com website might be missing out on approximately a thousand visitors daily. Our AI powered traffic system is tailored to increase your site’s visibility: https://tinyurl.com/yck6rcea

We’re offering a free trial that includes 4,000 targeted visitors to show the potential benefits. After the trial, we can supply up to a quarter million targeted visitors per month. This solution could greatly increase your website’s reach and traffic.